Derivatives Market in Malaysia

A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts defined by the exchange. Futures contracts are derivatives contracts to buy or sell specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future.

All You Need To Know About Derivative Markets Ipleaders

Amendments to the Direct Market Access Handbook DMA Handbook issued vide TP Circular 232010.

. A commodity market is a market that trades in the primary economic sector rather than manufactured products such as cocoa fruit and sugarHard commodities are mined such as gold and oil. We provides operates and maintains equity interest rates bond agricultural commodity crude palm oil and palm kernel metal commodity gold and tin futures and options market trading and settlement services. It plays an important role in generating economic growth for the country.

Annexure 1 Rule Amendments. His resignation effective Aug 1 is due to him taking up a new regional role based in Singapore covering. RTTNews - The Malaysia stock market has moved higher in four straight sessions gathering more than 40 points or 27 percent along the way.

The ICM functions as a parallel market to the conventional capital market and plays a complementary role to the Islamic banking system in broadening and deepening the Islamic financial markets in Malaysia. For matters relating to Investor Relations. 29 May 2017 Trading Participant Circular No.

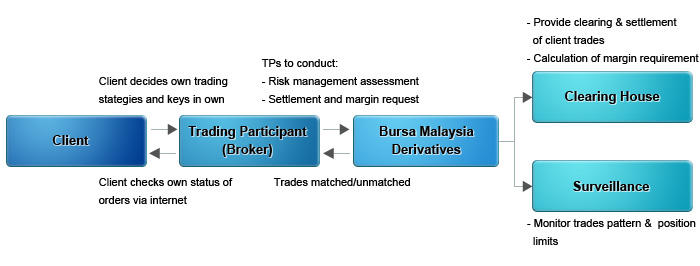

Futures exchanges provide physical or. The Kuala Lumpur Composite Index now rests just above. Bursa Malaysia Derivatives Berhad is a subsidiary of Bursa Malaysia Berhad established in 1993.

Samuel Ho Hock Guan. Annexure 2 Amendments to DMA Handbook Effective. Amendments to the Rules of Bursa Malaysia Derivatives Berhad Rules of Bursa Derivatives.

Futures contracts are the oldest way of investing in commodities. The ICM is a component of the overall capital market in Malaysia. Citation needed Commodity markets can include physical trading and derivatives trading using spot prices.

It has always been Bursa Malaysias priority to demonstrate the highest standards of integrity to our shareholders and the investment community. It is actively used by both institutional and retail investors in their respective trading portfolios. FKLI is a Ringgit Malaysia MYR denominated FTSE Bursa Malaysia Kuala Lumpur Composite Index FBM KLCI Futures Contract traded on Bursa Malaysia Derivatives providing market participants exposure to the underlying FBM KLCI constituents.

Bursa Malaysia Bhd on Friday announced the resignation of Samuel Ho Hock Guan who has been the chief executive officer CEO of Bursa Malaysia Derivatives since 2018. VCM Derivatives Market Cooling-off Period Trigger History. We are committed to building long-term relationships based on fair and timely disclosure transparency openness and constructive communication.

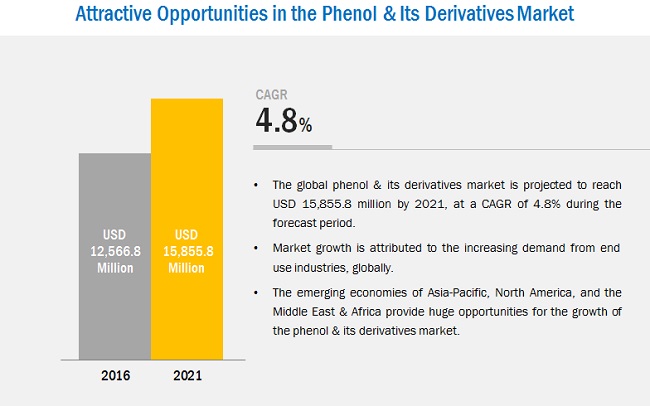

Phenol Derivatives Market By Derivatives Region Global Forecast 2026 Marketsandmarkets

Global Bioplastics Market Size Industry Trends Share And Forecast 2019 2025 Marketing Industrial Trend Dow Chemical

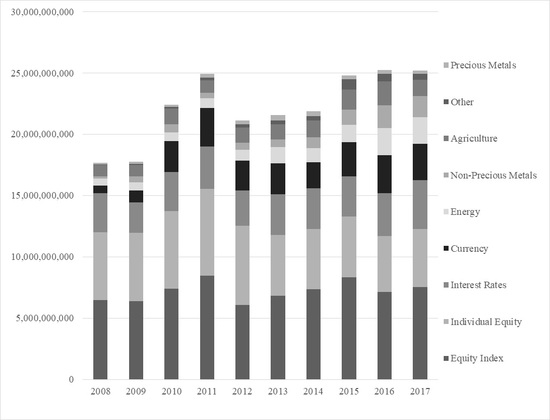

Jrfm Free Full Text The Importance Of The Financial Derivatives Markets To Economic Development In The World S Four Major Economies Html

Comments

Post a Comment